The most popular advertising channels for SMBs in the Home and Trade Services vertical, according to BIA/Kelsey’s Local Commerce Monitor™, Wave 18,survey of small-and-medium businesses, are a mix of paid and free media. Media Ad View Plus (MAV), BIA/Kelsey’s forecast of advertising dollars across local markets and nationwide, also shows that General Services (the vertical that includes Home and Trade Services) spends heavily on traditional media for advertising and promotion. That reliance is expected to continue to lessen over the next few years, with digital taking a larger piece of the pie.

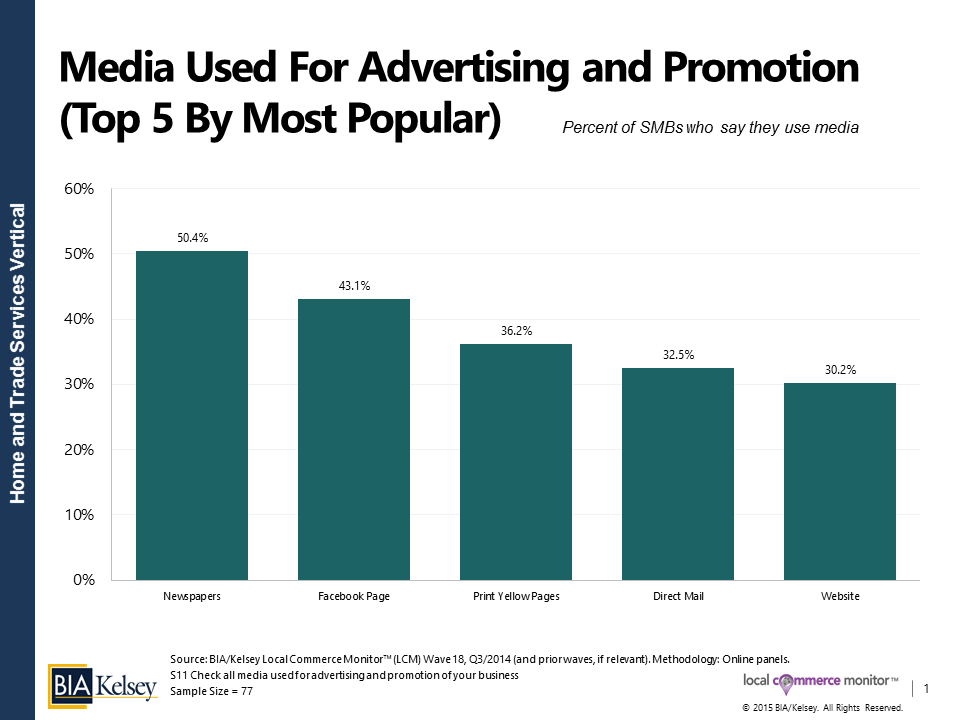

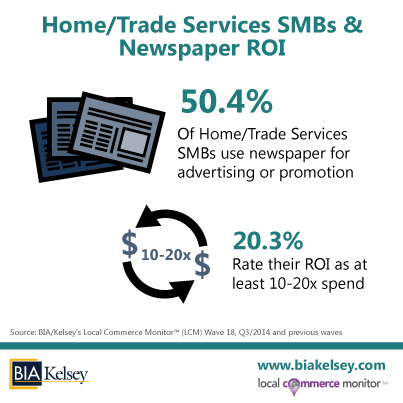

Home and Trade Services SMBs report their most popular channels to use are from traditional media: newspapers, print yellow pages and direct mail. Digital is also part of the Top 5 most used with Facebook pages and a website rounding it out. Given the vertical’s heavy reliance on traditional media, there’s an opportunity for traditional media players to bundle digital media to their offerings.

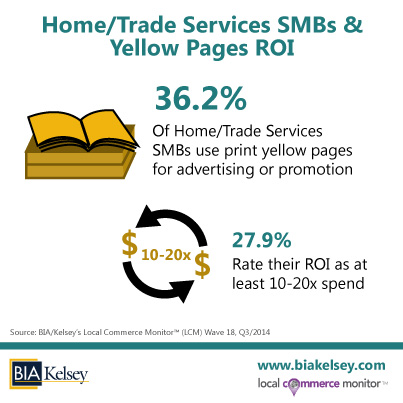

Home and Trade Services is the only vertical industry in our study with print yellow pages among the Top 5 media used for advertising and promotion, and was only in the Top 10 of one other vertical — Professional Services. Print yellow pages also had the highest return on investment (ROI) of the top three traditional media — with nearly 28% saying that their ROI on print yellow pages was either excellent (10-19x) or extraordinary (over 20x) spend.

SMBs in the Home and Trade Vertical had an average annual advertising spend of $12,573 in Wave 18 (Q3/2014), down from $19,238 in the previous wave (Q3/2013). Home and Trade Service SMBs overall will not increase their ad budget in 2015. Nearly 61% of the SMBs in the Home and Trade Services vertical reported that they would maintain their ad spend over the next 12 months and 20.8% say they will increase. While SMBs in the Home and Trade Services utilize traditional media, their budget allocation for digital is increasing. On average, SMBs in the Home and Trade Services vertical allocated 24.7% of their advertising budget to digital in the last 12 months. Over the next 12 months, they report plans to increase it to 27.7%.

Local media players, especially in the traditional channels, have an opportunity to continue to serve their Home and Trade Services SMBs through traditional channels as well as grabbing more of their ad dollars by offering digital products.

Clients of the BIA/Kelsey Advisory Services can find the full Home and Trade Services vertical report here. Interested in finding out more about our LCM survey? Click here.

This Post Has 2 Comments

Leave a Reply

You must be logged in to post a comment.

Very interesting article, thank you. Could you please define the categories of Home & Trade Service Verticals? i.e. Roofers, Heating Contractors, etc…

Terry – the Home and Trade Services vertical is comprised of Trades, Lawn Care/Landscaping, Property Management/HOA, Construction and Contractors. Of those, Construction and Contractors have the largest representation.