Local video ad platforms attract significant ad spending because video in its various forms is a powerful messaging format. Examining each local video channel through different filters reveals interesting patterns for growth and revenue. Let’s take a look at a few.

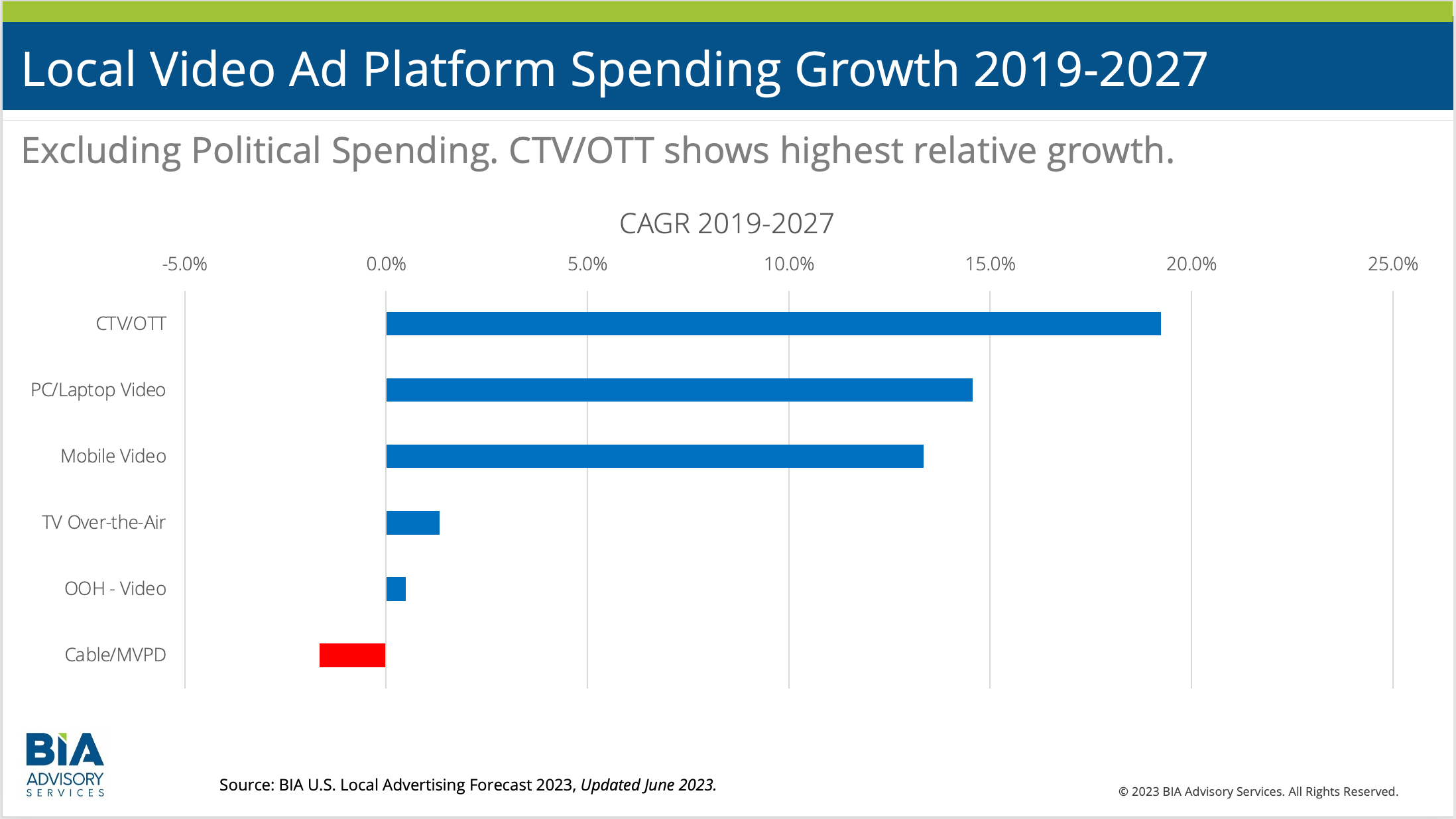

Relatively new to the local video media mix is CTV/OTT or streaming ads (pre/mid/post roll) inside full-length, premium video content running in ad-supported services that sell impressions largely targeting TV sets as the display device. Excluding political spending – to normalize the long-term trends across six video media platforms – CTV/OTT has the fastest CAGR growth in the 2019-2027 period. PC/Laptop and Mobile Video ad spending come in, respectively, second and third place. TV OTA is a distant fourth in CAGR growth and Out-Of-Home (OOH) video has the slowest CAGR growth in this period. Cable (MVPD) is the only local video ad platform showing a decline in growth.

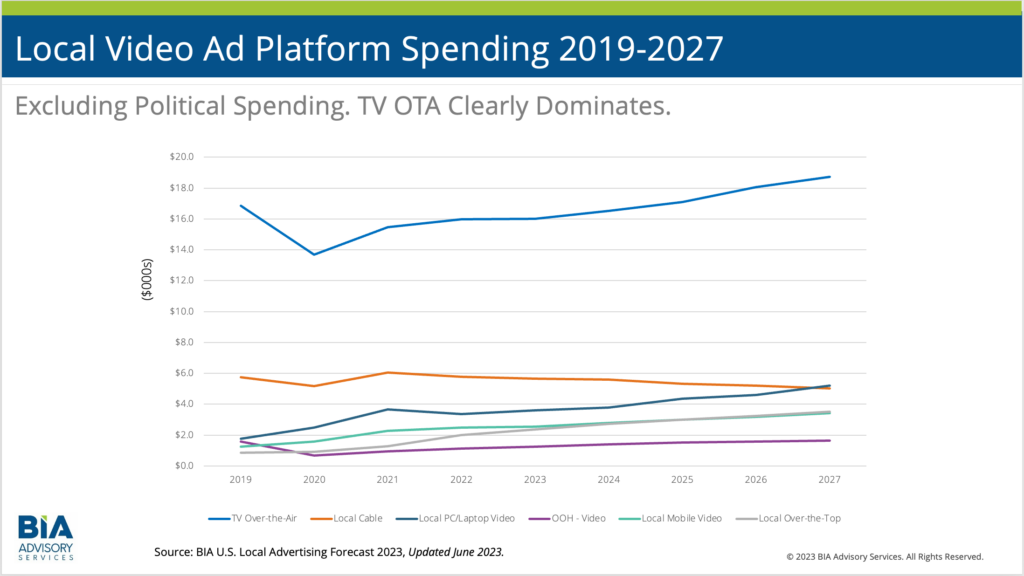

However, when we look at absolute spending and not growth rates (again, excluding Political), we see a different story. TV OTA is the clear and consistent leader in attracting local video ad dollars.

Even with a negative dip in the early pandemic years, TV OTA’s overall strength in local video media spending reigned as the category leader. Cable/MVPD took its own pandemic dip and after a brief reprieve in 2021 resumed its secular spending journey downward. While CTV/OTT has an impressive growth rate, in terms of local video ad dollars, the PC/Laptop digital video platform spending is growing at a higher level than CTV and will remain there during BIA’s forecast period. Local Mobile Video’s spending trajectory starts higher than CTV in this period, but CTV will catch up in 2023.

Five more key takeaways:

- Excluding Political spending in local video ad platforms, local broadcast TV (TV OTA) reigns supreme in total spending as far and away as the category leader. However, its CAGR growth rate is much lower than the leaders in local video.

- In terms of relative growth, CTV/OTT’s CAGR in the 2019-2027 period is in its own league running ahead of PC/Laptop and Mobile, respectively the 2nd and 3rd place video ad platforms.

- Cable/MVPD video ad spending is in secular decline. Those video ad dollars are migrating elsewhere. For video media sellers, this creates an opportunity to target Cable as the local video ad platform with the second-highest spending level, but a negative growth rate.

- While much of the excitement is well-earned by the CTV/OTT video ad platform that primarily targets TV set impression inventory, the strength of video ad inventory spending in PC/Laptop and Mobile video is impressive in terms of expected growth.

- As marketers and agencies invest more in local video activations in CTV/OTT, there will still be plenty of growth in PC/Laptop and Mobile. Media sellers will do well to bundle in all three tops of local video ad inventory to create a solid, full-funnel media solution for clients.

We’re rolling out our 2024 U.S. Local Advertising Forecast. Let us know if you want more details on different media spends in local video or other key areas of the media marketplace. For more information about BIA Advisory Services forecasts and local market intelligence, click here.

This Post Has 0 Comments