In light of the Media Rating Council recently defining Over-the-Top (OTT) to be Connected TV, I recently spoke with Brian Hunt, head of OTT/CTV advertising sales at Sinclair Broadcast Group. Brian runs Sinclair’s CompulseOTT, an aggregated data-driven platform with a full tech stack in the Connected TV space. We talked about the OTT business model, the evolving definitions within the space and how this is all bigger than broadcast for screen use. Here are takeaways from the discussion, along with details about our upcoming webinar on OTT.

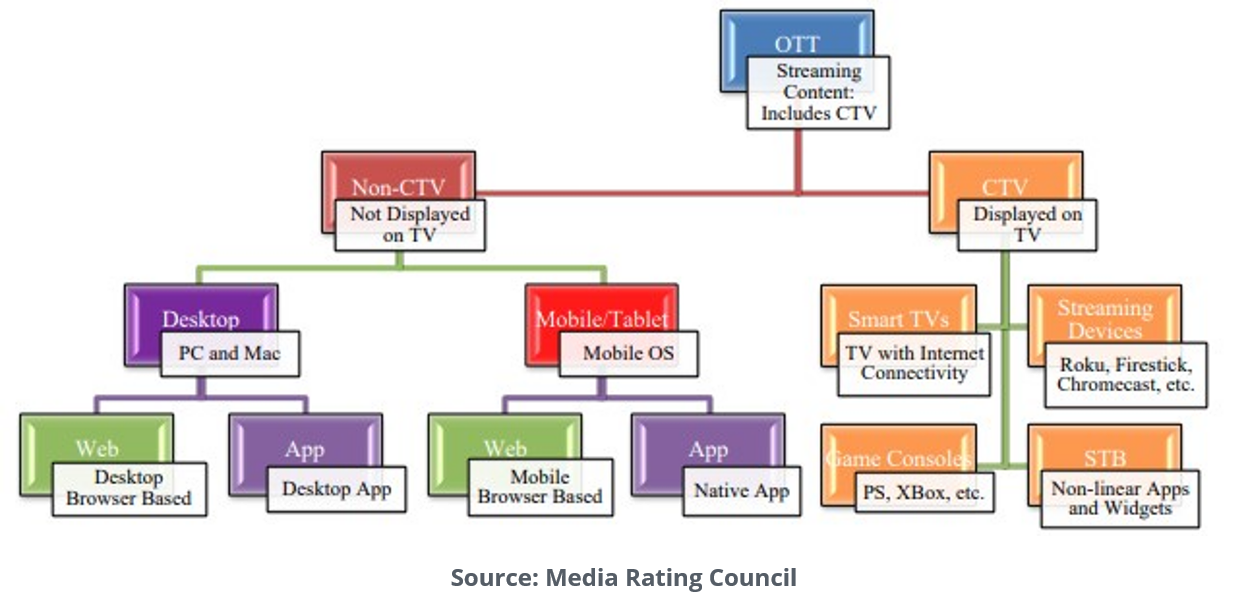

First, there has been confusion and inconsistent use of OTT and CTV as terms. What the Media Rating Council did was to walk though all the variations and define exactly what CTV is. Essentially, “OTT” is the catch-all term and “CTV” refers to Internet video displayed on a TV set versus PC, Mobile, Tablet or some other device.

Given the varying use of the terms “OTT” and “CTV” (Connected TV), Hunt noted, “If you are selling OTT in the market, it has to be CTV, viewing on a TV set connected to an Internet delivered service.” Hunt said that since 99 percent of CompulseOTT impressions are on Connected TV sets, and if he had it to do again, he’d start off by calling it CompulseCTV.

CompulseOTT is an aggregator of local OTT impressions and targets primarily Tier 2 (Regional) and Tier 3 (Local) businesses and agencies. Given the growth in OTT viewership, this is a hot part of the media mix. Nielsen reported that in its August edition of The Gauge that 28 percent of TV content was accessed via OTT versus 24 percent from broadcast TV. While this makes OTT a serious contender as an ad platform, it is even better news for local TV groups that have both a broadcast TV and OTT offer. As Hunts points out, “Our primary target is the cord-cutting audience that complements what broadcast TV delivers to advertisers.”

CompulseOTT differentiates itself in the market in several ways. Sinclair has assembled its own tech stack via a series of acquisitions including ZypMedia and Datasphere. It works with TruOptic and Liveramp to target third-party data-driven audience segments.

To help ensure quality impressions and brand safe content for advertisers, CompulseOTT works with vendors such as Oracle’s MOAT, and Data Atlas to protect against fraud and invalid traffic. Hunt argues that, “With all the fraud tollgates on the Internet on the SSP and DSP side and vendors providing fraud protection services, there really isn’t that much fraud, especially in OTT.”

CompulseOTT is sold directly to in-market local and regional advertisers by Sinclair’s local sales team from their TV stations and the Regional Sports Networks (RSNs). The biggest vertical typicallty is Auto but having serious supply chain issues. Other big verticals are Education, Political, Medical/Healthcare, Legal and QSR.

The next big thing for CompulseOTT? “We’re excited at Sinclair about the Compulse Data Kitchen that will be coming out in 4Q 2022. This service will support cross-platform consumer targeting for existing and even enterprise buyers.”

You can hear more of what Brian says in his podcast with us, Targeting Local Viewers in OTT.

Then, join us Tue, Oct. 5 at 2pm for BIA’s next OTT webinar. We welcome speakers from Nielsen, Premion and Simpli.fi. Click here for details and to register.

This Post Has 0 Comments