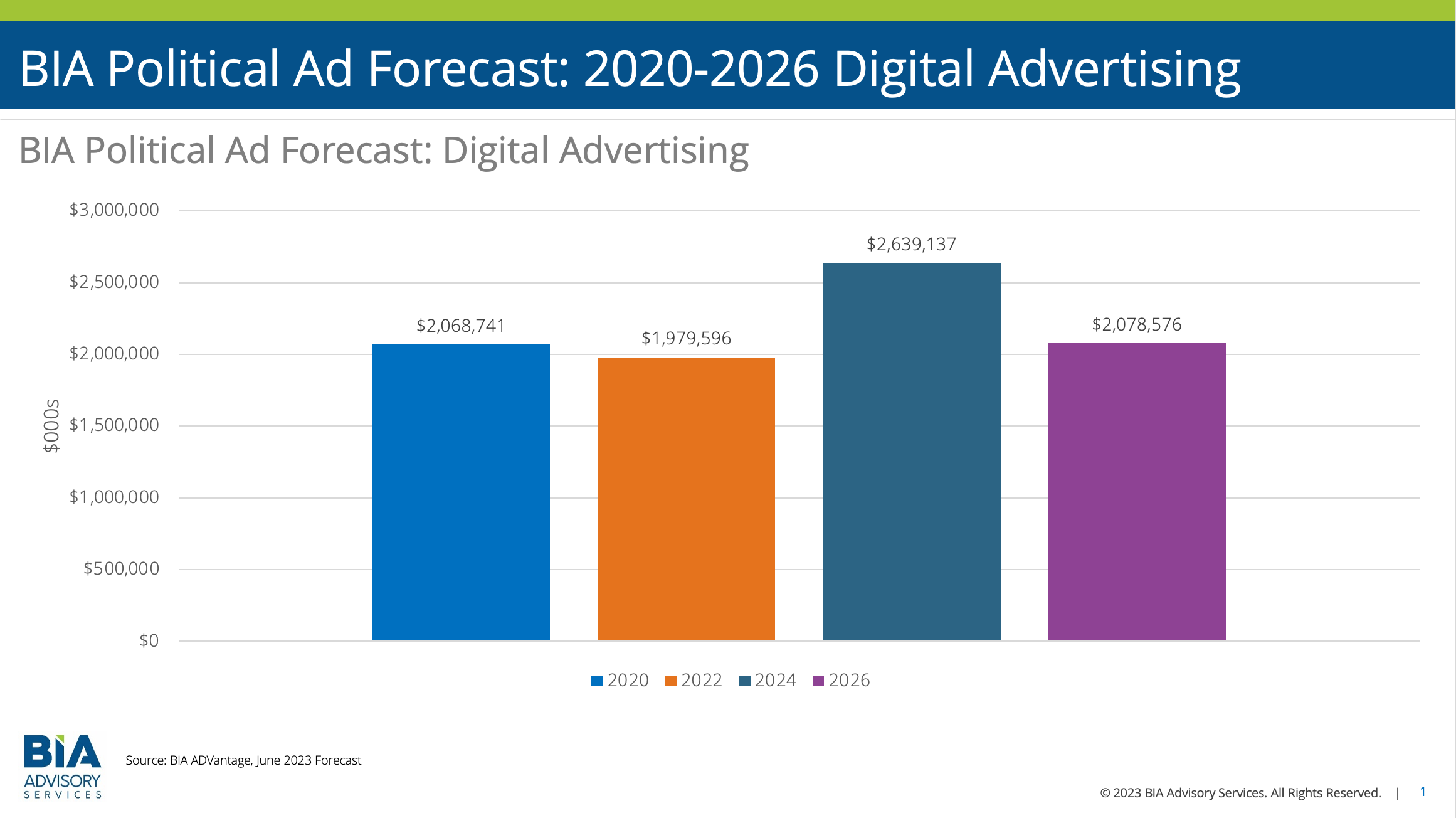

In the 2020-2026 time frame, Political digital ad spending estimates for even years hovers around $2 billion. However, in the 2024 general election cycle, BIA forecasts a 28 percent jump in digital media spending from 2020’s $2.07 billion to $2.64 billion in 2024. National, state, and local candidate and issue campaigns will be targeting digital audiences across different types of ad inventory including Search, Video, Display, and Classified formats. Buying will lean heavily toward data-driven programmatic ad platforms to reach specific audience segments likely to register and vote.

Political Spending by Digital Media

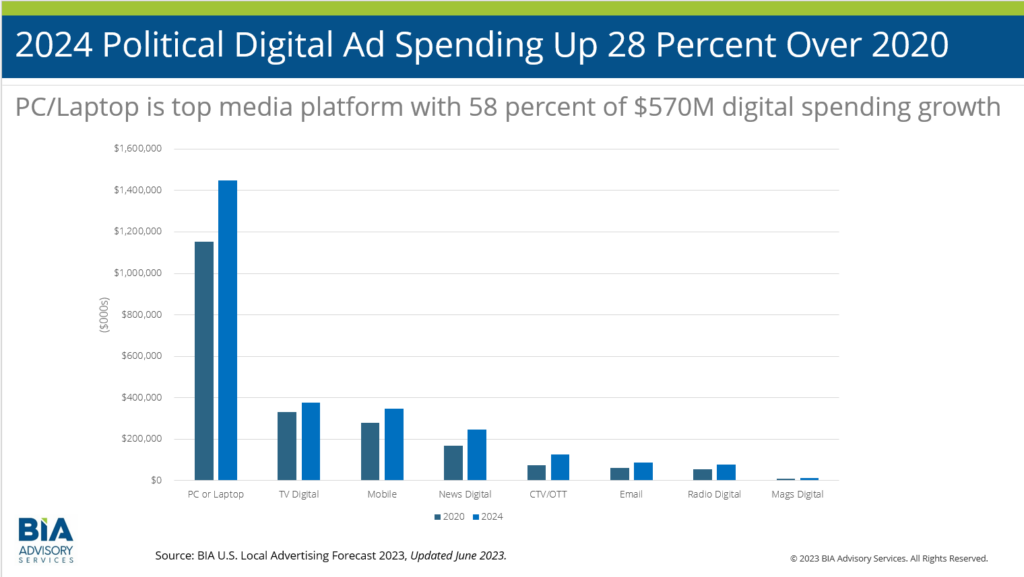

In terms of spending by digital media platform, the PC/Laptop ad platform generates both the highest relative growth and the most overall spending. CTV/OTT spending also shows a high percentage growth but pales in comparison to ad spending targeting PC/Laptop devices.

BIA’s “Political” vertical comprises spending by establishments primarily engaged in promoting the interests of national, state, or local political parties or candidates. Included are political groups organized to raise funds for a political party or individual candidates.

With this huge increase in 2024 Political digital ad spending, there is a one-time opportunity for media sellers to prioritize digital platforms in their sales efforts.

BIA defines “digital ad spending” as ad dollars spent across the eight digital media platforms we track: CTV/OTT, Mobile, PC/Laptop, Email, TV Digital, Radio Digital, Newspaper Digital, and Magazines Digital.

Political Spending by Digital Ad Inventory Types

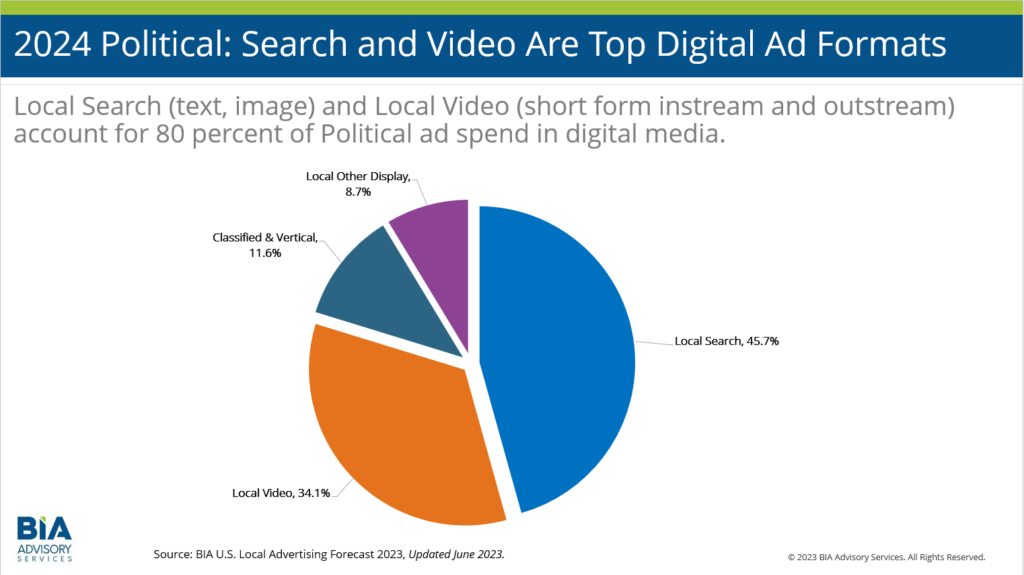

In terms of digital ad inventory types, most 2024 Political ad dollars in digital will be allocated to Local Search (45.7 percent) and Local Video (34.1 percent). Search ad inventory comprises text, images, or [outstream] video.

BIA uses a few different different video ad classifications. CTV/OTT is full-length, premium video primarily displayed on TV sets. BIA’s “Local Video” ad inventory comprises short-form video ads running as instream inventory (pre-roll, mid-roll, or post-roll inside video players). Video Display ads refer to outstream video ad spending assigned to other ad channels such as Search and Email.

Key Take-Aways

- Political digital ad spending in 2024 will increase by one-third over prior years.

- Three-quarters of this digital spending will be for Search and Local Video ads.

- The biggest growth in digital Political ad spending will be for PC/Laptop ad inventory.

- Media sellers can address this demand by including this type of ad inventory in their proposals to agencies and campaigns.

You can get more data from BIA’s political forecast in the recently published Local Market Political Ad Spend Report 2023-2024, which details political local ad spend in all 210 TV markets for key media in 2023 and 2024. The report is now available for purchase in our shop here. BIA ADVantage clients can login and download the report from the Reports & Webinars section.

This Post Has 0 Comments