(Update April 10, 2017 – Join us for our quarterly update on programmatic Thursday, April 13 at 2 pm eastern. Details & Registration here: Local TV Marketing and Programmatic, Advanced TV and Contextual Audience Networks.)

Programmatic TV is about data first, then workflow automation. Some might argue that the automation side of programmatic is actually fairly labor intensive at this point, given all the moving parts and pieces.

Clearly, the market is moving both towards more data-driven media planning and buying and what some are calling, “the new localism” in pursuit of growth. Local market investment and activation is growing. We see significant upside growth in local video overall and most of that growth splits between digital video and local TV.

We’ve seen marketers re-weight their campaigns reducing spend in local TV to move some spend into digital and then re-weight back into local TV because of the success they typically see. Marketers have more targeting and tracking in digital which is very helpful. Programmatic TV platforms add much better targeting to broadcast TV. That makes more competitive with digital.

Because of this, and because local TV ad inventory works well by itself and even better in combination with digital, we see strong prospects for local TV. As local TV innovates, perhaps with deployment of ATSC 3.0 and its new features of content personalization, targeting and interactivity, broadcast TV at the local level will become even more competitive with digital. This is the kind of background thinking we’re factoring into our forecast and insights around the driving trends.

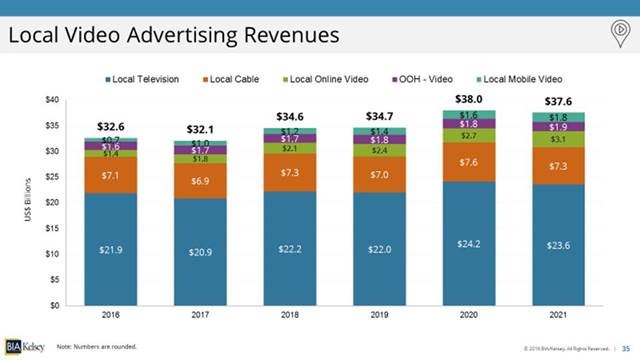

BIA/Kelsey’s forecast for video advertising of all types targeting local audiences is that spending will grow $5B from $32.6B in 2016 to $37.6B by 2021. Certainly, digital advertising and video inventory are the high growth components of the marketplace as we show in the chart below. We’re forecasting Local Mobile Video spending alone to grow 250%. That sounds impressive, but it’s off a low base so growth will be from $700M to $1.8B. Even with Facebook’s announcement to double down on what essentially is mobile video advertising (since almost 85% of their ad revenue comes from mobile), the actual magnitude of the market impact shown be seen in context. Online video grow even higher growth, from $1.4B to $3.1B or $1.7B overall.

Le t’s look at the mix of local video spending. Local broadcast TV accounts for $1.7B of the growth to 2021. MVPD (aka cable) adds $200M. Linear TV ad platforms (broadcast TV stations and MVPD) account for about 40% of the growth in local video spending. Much smaller growth than we see on the digital side. However, these platforms account for 82% of the total spending in local video.

t’s look at the mix of local video spending. Local broadcast TV accounts for $1.7B of the growth to 2021. MVPD (aka cable) adds $200M. Linear TV ad platforms (broadcast TV stations and MVPD) account for about 40% of the growth in local video spending. Much smaller growth than we see on the digital side. However, these platforms account for 82% of the total spending in local video.

Programmatic TV certainly is coming to local, but when and how big will this grow? We get anecdotal evidence from our research that it’s perhaps 1-2% of local TV sales now. We’re projecting that programmatic local TV may double or triple over the next several years to perhaps 3%-6% of total ad spend. Most of the current programmatic activity in local TV inventory is coming from WideOrbit and ITN. As local TV stations open up more inventory to programmatic channels and new entrants like Videa and others ramp up their efforts, we expect to see that small percentage increase. We certainly expect to see healthy growth in local programmatic TV and more generally advanced TV to also include connected TV, OTT.

What might bend the needle in local TV ad spending is the increased use of data infusion to help marketers and agencies more effectively match their consumer target segments to media audiences that over-index in their specific attributes of interest. Programmatic TV and more effective and smarter local Data Management Platforms are starting to change the local TV culture around the advertising value proposition and how both the buy-side and sell-sides are approaching it.

We expect to see continued innovation…and adoption of what is essentially the new culture of programmatic TV selling in local TV, adding data infusion and workflow automation. This will make linear TV platforms like broadcast and cable more competitive and indeed may challenge some of that growth in digital channels we are forecasting.

Report Availability

More information about “Programmatic is Coming to Local TV in 2017“ including how to purchase, is available at http://bit.ly/Programmatic2017Q12017. BIA/Kelsey content subscribers will receive the report this week.

Quarterly Update

Join us for our quarterly update on programmatic Thursday, April 13 at 2 pm eastern: Local TV Marketing and Programmatic, Advanced TV and Contextual Audience Networks.)

This Post Has 0 Comments