We all expect political advertising spend to go off the charts in 2024, but before then, there is spending to capture now with key issues and elections fueling early spending. Let’s start with the spend estimates first.

With the 2023 elections a little over two months away, BIA is estimating local political advertising will be around $534 million. This spend is an increase of 30% from $410 million in 2021, and more than double the $254 million in pre-pandemic 2019.

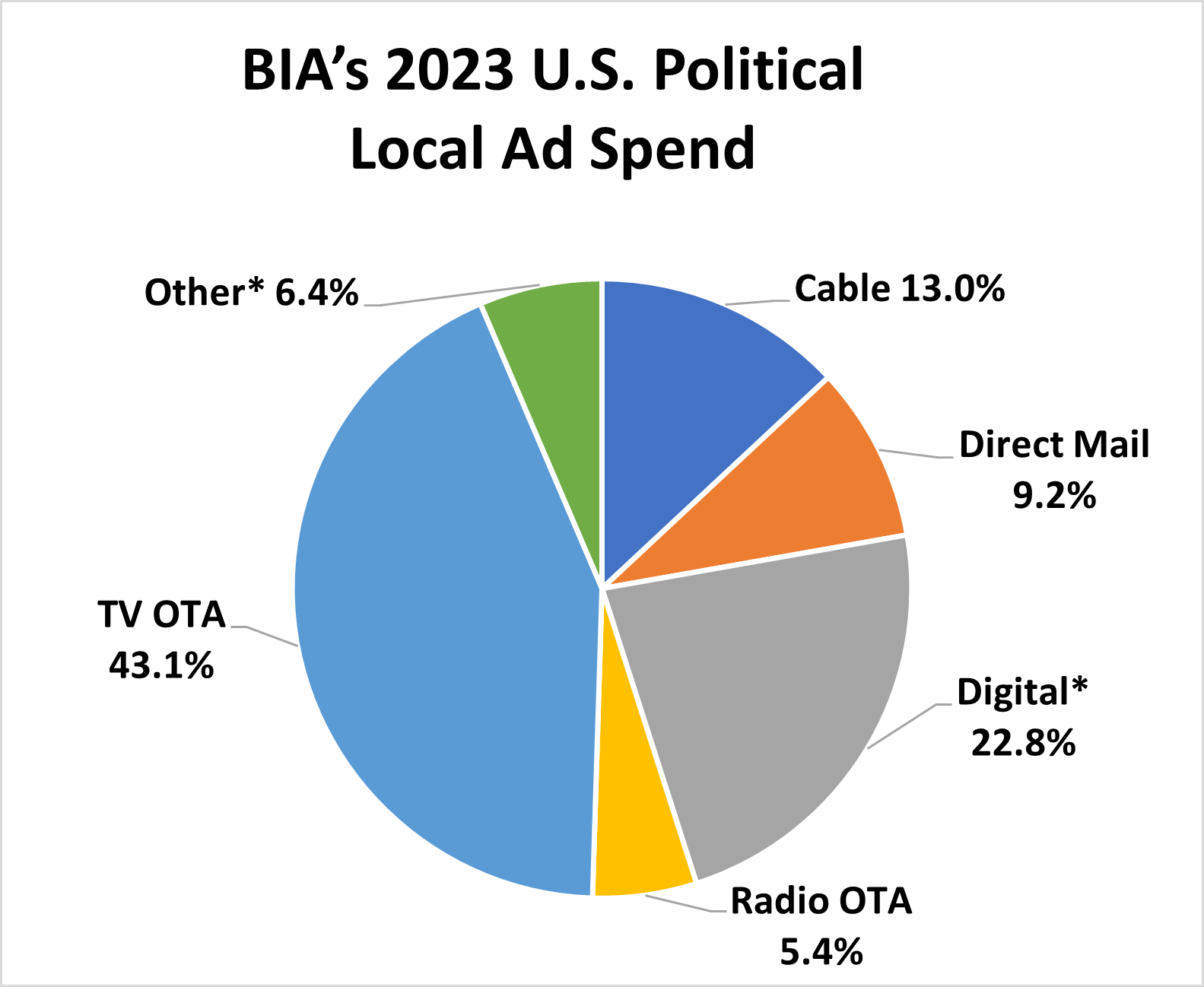

As expected, BIA anticipates TV over-the-air will hold its position as the dominant media for political advertising this year. TV OTA is estimated to get 43 percent of the spend. Combined, digital channels* continue to capture share and in 2023 we anticipate will account for 22.8 percent share of wallet. Two other major traditional channels, Cable TV and Radio OTA, will receive 13.0 percent and 5.4 percent respectively. One media losing share is Direct Mail; we estimate it will have 9.2 percent this year, which is a drop from 22.8 percent in 2019.

Fueling political advertising this year is issue-based spending. According to AdImpact, the U.S. saw $174 million in issue-based advertisement spending in the first half of 2023, which accounted for 38% of all political advertisement spending the company tracked during that period. The biggest issues covered in the advertisements included Healthcare, by far the biggest, followed by clean energy, fundraising, gun control, and the economy.

Plus, in addition to local government elections being held nationwide, three states are holding Gubernatorial elections in 2023, along with other state executive positions: Kentucky, Louisiana, and Mississippi. However, even with increased spending, these statewide elections aren’t enough to boost any of their local TV markets to the Top 5 in 2023.

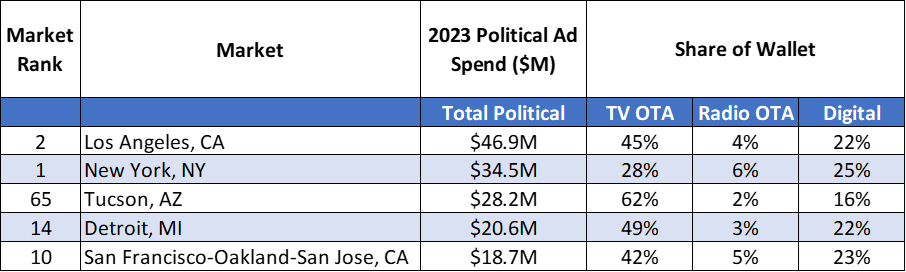

So which markets are going to see the most political local ad spend in 2023? Not surprisingly, the two largest markets, Los Angeles and New York, are at the top of the list. But coming in third for total Political local ad spend in 2023 is market number 65 – Tucson, Arizona. Rounding out the top 5 are Detroit, Michigan (14) and San Francisco-Oakland-San Jose, California (10).

In four of the five markets, TV OTA is forecast to get the biggest share of wallet, just as it is nationwide. In Tucson, TV OTA is forecasted to get a whopping sixty-two cents out of every dollar spent on political advertising in the market in 2023. But in New York City it’s a different story. In the NYC market, TV OTA accounts for 28 percent of political local ad spend, which is only a few percentage points above digital media’s share of wallet.

Top 5 Markets by Total Political Local Ad Spend in 2023

Get more from BIA’s political forecast in the recently published Local Market Political Ad Spend Report 2023-2024, which details political local ad spend in all 210 TV markets for key media in 2023 and 2024. The report is now available for purchase in our shop here. BIA ADVantage clients can login and download the report in the Reports & Webinars section.

Stay tuned! This post is the first in a political series our analyst team will be hosting on the BIA Blog throughout the rest of the year. Want to join us? Email us at info@bia.com and join us to discuss all things political.

*Digital channels include Digital Directories, E-Mail, Magazines Digital, Mobile, Newspaper Digital, PC/Laptop, Radio Digital, Television Digital, TV Over-the-Top (TV OTT). Other traditional channels include Print Directories, Print Magazines, Print Newspapers, and Out-of-Home (OOH).

This Post Has 0 Comments