2022 has been a year of ups and downs, creating challenges within the local advertising marketplace. Going into the new year, auto supply chains, inflation and a potential recession are all still concerns. With that backdrop, BIA has issued its 2023 U.S. Local Advertising Forecast, a significant gauge on how the economy will affect overall local advertising nationwide and within local markets.

The forecast offers both a nationwide and local market view of ad spend across 16 media (traditional and digital channels) and 96 sub-verticals (such as Healthcare, Auto, Retail, Finance, Leisure). It identifies where BIA anticipates both growth and decline in spending and revenue. Public findings from the forecast can be read below.

You can hear about the underpinnings of the forecast in the podcast, Economic Influencers on the 2023 U.S. Local Advertising Marketplace, with BIA’s CEO & Founder, Tom Buono, and VP Forecasting & Analysis, Nicole Ovadia. BIA’s clients can see the latest forecast in the BIA ADVantage™ platform. Questions on the latest forecast can be sent to advantage@bia.com.

—————————————————-

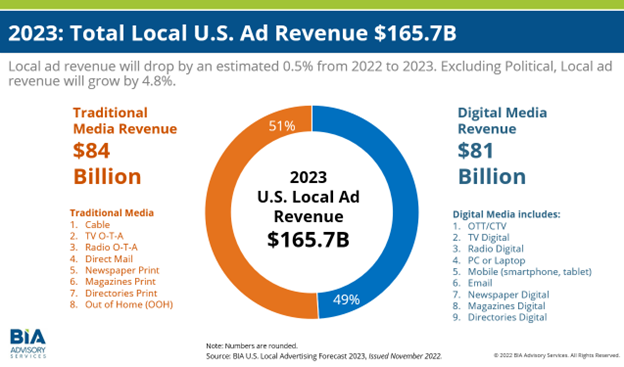

CHANTILLY, Va. (Nov 30, 2022) – In its newly released 2023 U.S. Local Advertising Forecast, BIA Advisory Services estimates revenues across all media in the U.S. will reach $165.7 billion in 2023, a decline of 0.5 percent from the firm’s final estimate of $166.5 billion for 2022. Removing political advertising revenues from the estimate, BIA projects $165.2 billion in total local advertising next year, a 4.8 percent increase in local advertising year-over-year. The almost flat revenue projections for the year indicate continued economic and supply chain concerns, yet the forecast is more bullish starting mid-2023. The updated local advertising forecast for 16 media and 96 sub-verticals is now available in the BIA ADVantage™ platform.

“This year has been filled with contrasting economic indicators creating several challenges for the local advertising marketplace,” said Nicole Ovadia, VP Forecasting & Analysis, BIA Advisory Services. “Supply chain issues continued to plague the first couple of quarters of 2022 making it difficult for local media sellers. In the summer, we had higher hopes for the remainder of the year; however, inflation issues and recession fears started to set in and that stalled anticipated rebounds in key verticals such as automotive.”

“For our 2023 forecast we lowered near-term expectations to reflect the current economic climate that we anticipate will stay with us into next year.”

The 2023 forecast shows digital continues to gain on traditional media, growing its share to 49 percent of the overall advertising spend at $81 billion. Traditional media ad revenue is 51 percent of the ad spend at $84 billion. BIA has been slightly decreasing its digital estimates over the last couple of forecasting rounds because of opt-in privacy measures on Apple and Android devices that have slightly impacted mobile advertising growth.\

The top three paid media channels for 2023 include direct mail ($37.2B), mobile ($33.5B), and PC/Laptop ($29.0B). As we’ve previously reported, direct mail’s growth has been slowing substantially and is expected to continue that pattern at +1.5% in 2023 due to rising costs and the continued growth across all digital channels. TV Digital, Over-the-Top (OTT), and Mobile will rise +17.3 percent, +12.3 percent, and +8.1 percent respectively, with TV digital growing from a smaller base than the other media.

The business verticals that are expected to grow, according to BIA’s 2023 U.S. Local Advertising Forecast are: education (9.7 percent), retail (8.7 percent) and, restaurants (7.5 percent). Notable declining verticals include political (-78 percent), leisure and recreation (-4.9 percent) and real estate (-1.0 percent). The automotive vertical is projected to grow 4.9 percent, but not until the latter part of 2023.

“When it comes to advertising in the business vertical market, education offers a tremendous opportunity for local media in 2023, with companies offering opportunities for employees to improve their training and with people who are experiencing a job transition often enrolling in classes to advance their education,” said Ovadia. “For other verticals, too, I believe they will pop potentially faster if we see the Fed slow or stop raising interest rates, inflation tamed and a smaller than anticipated recession. Even with the economy in flux, the continuing strength of the labor market and corporate profits makes me feel confident that key verticals will show growth in the year ahead.”

Webinar and Podcast with More Findings from the 2023 U.S. Local Advertising Forecast

BIA is hosting the public webinar, Top Recession-Proof Verticals for 2023, on Wednesday, Nov. 30 at 2 pm to examine opportunities for local sellers. Registration is free and can be watched on-demand after its airing using the same link. Plus, BIA’s Tom Buono, CEO & Founder, and Nicole Ovadia discuss top economic takeaways from the forecast on a Leading Local Insights Podcast. Listen here.

Accessing the Updated 2022 U.S. Local Advertising Forecast

For BIA clients, the company’s BIA ADVantage platform now contain the updated 2023 U.S. Local Advertising Forecast, which covers 16 media and 96 sub-verticals and includes comprehensive local television and local radio forecast updates and market profile data. To purchase access to BIA’s forecast data, email advantage@bia.com.

About BIA Advisory Services

BIA Advisory Services is the leading authority for data-centered insights, analysis, strategic consulting, and valuation services for the local media industry. Since 1983, BIA has been a valuable resource for traditional and digital media companies, brands and agencies, the financial and legal community serving media and telecom, as well as the FCC and other government agencies. Today, we offer comprehensive local market advertising intelligence in our BIA ADVantageTM service to help clients discover the path to their best opportunities. Learn more about our offerings at http://www.bia.com.

Media Contacts:

MacKenzie Lovings

(703) 802-2991

mlovings@bia.com

Robert Udowitz

(703) 621-8060

rudowitz@bia.com

This Post Has 0 Comments