ATSC 3.0 now has an official name and logo, and perhaps it’s a bit more likely to roll off consumers’s tongues and stick with them: “NextGen TV.”

Branded by the Consumer Technology Association (CTA) and coordinated with the ATSC, NAB and other industry groups, the intention behind the logo is to reveal NextGen TV as both a new consumer distribution platform and a new local advertising platform.

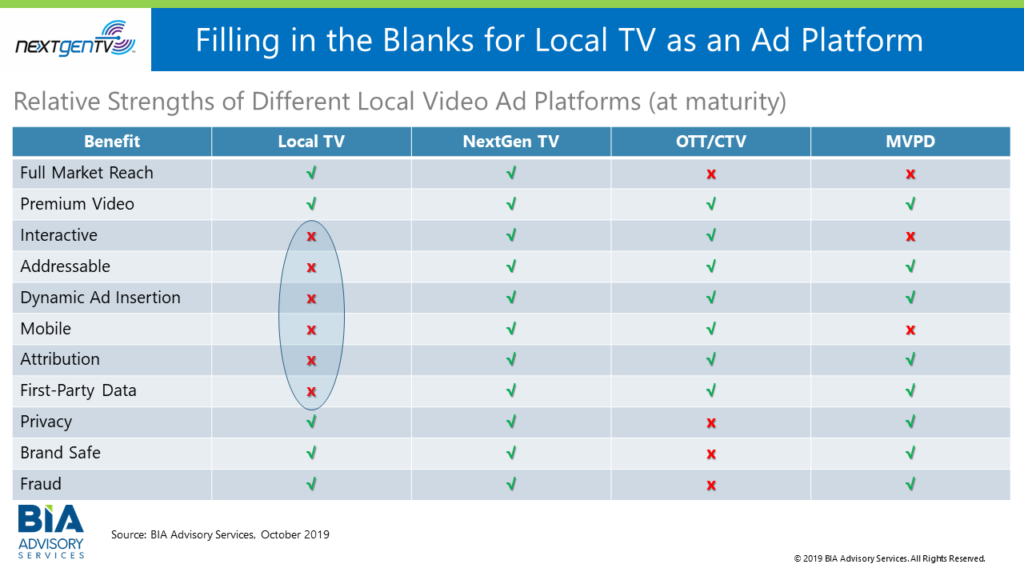

Currently, most of the attention for NextGen TV focuses on consumer benefits and gets a bit soft on specific revenue models for local television broadcasters. In actuality though, NextGen TV deployments will add a new local ad platform for marketers and agencies to include in the campaign planning. Operating as a platform, NextGen TV complements and extends the value proposition of local television in several significant ways.

In the chart below, we call-out what we mean as we compare four local ad platforms featuring full screen video ad environments. Each ad platform offers a full-screen, premium video experience. But the platforms have different value propositions for advertisers targeting local audiences.

- OTT is coming on to the local ad scene fast. BIA’s estimates put local ad spending in OTT at $598 million for 2018, but rising quickly to $2.31 billion by 2024. BIA defines “OTT” as Connected TV sets. Even so, for purposes of the chart below, we’ll give credit for “mobile” as an OTT benefit for sake of argument. If nothing else, an OTT subscriber could “cast” their mobile OTT subscription video to a full screen.

- MVPD has both linear and non-linear (AVOD) ad inventory and can do household-level addressable dynamic ad insertion. For the most part, MVPD ad units are not interactive as OTT/CTV ad units can be. Unlike OTT/CTV inventory, MVPD inventory has not been plagued at any scale by the threat of violating user privacy, runs ads in non-brand safe environments, and outright ad fraud. We’ll say MVPDs don’t have full market coverage here, but interconnects of course do a great job of addressing this limitation.

Local TV brings one benefit in particular that OTT and MVPDs platforms don’t – full market reach. However, when compared to the OTT/CTV and MVPD columns, we can see a number of areas where Local TV currently comes up short.

NextGen TV: Finally we come to the new kid on the block. At scale, NextGen TV brings full-market coverage, same as Local TV. But NexGenTV also fills in all the missing value props we see in Local TV – interactivity, addressable, dynamic ad insertion, attribution, and first-party data. Arguably, if all goes right in the tech, and perhaps more importantly in the business models, NextGen TV is set to become not only a new local ad platform for premium video, but one that fills in the blanks not just for Local TV but those we see in OTT and MVPD platforms as well.

In the Advanced TV space, BIA has a regular coverage program with webinars, reports, industry presentations and private consulting engagements sharing our local market analytics and helping clients develop strategies and business models. Check out some of our recent work here.

This Post Has 0 Comments