Pinterest is not the only place consumers go for inspiration and planning — in fact adding print to digital helps consumer recall.”Print ads (in magazines) can be read more leisurely, and be more evocative; they can encourage readers to fantasize, to put themselves in the picture,” according to a recent study Neuroscience May Explain Why Magazine Advertising Succeeds by MediaMax Network. According to the study campaigns that use traditional with digital channels are more effective and the least effective campaigns use online alone and, “Campaigns combining print and online also achieved significant lifts in ad effectiveness, beyond what a single platform would achieve.”

However, print advertising — particularly newspaper and yellow pages — has taken a hit in the news recently. The MediaMax study acknowledges that despite evidence presented that print and digital combined deliver key performance indicators (such as ad recall, persuasion, brand consideration, purchase intention and actual purchase), “some advertisers are reluctant to spend their ad dollars on print versions of magazines.”

While print advertising revenue is slowly declining while digital gains (see BIA/Kelsey’s forecast below), print is still an important part of the advertising pie, as shown by the latest wave of the Local Commerce Monitor survey of small and medium businesses and U.S. Local Advertising Forecast from BIA/Kelsey.

Small Businesses Use Print and Other Traditional Channels

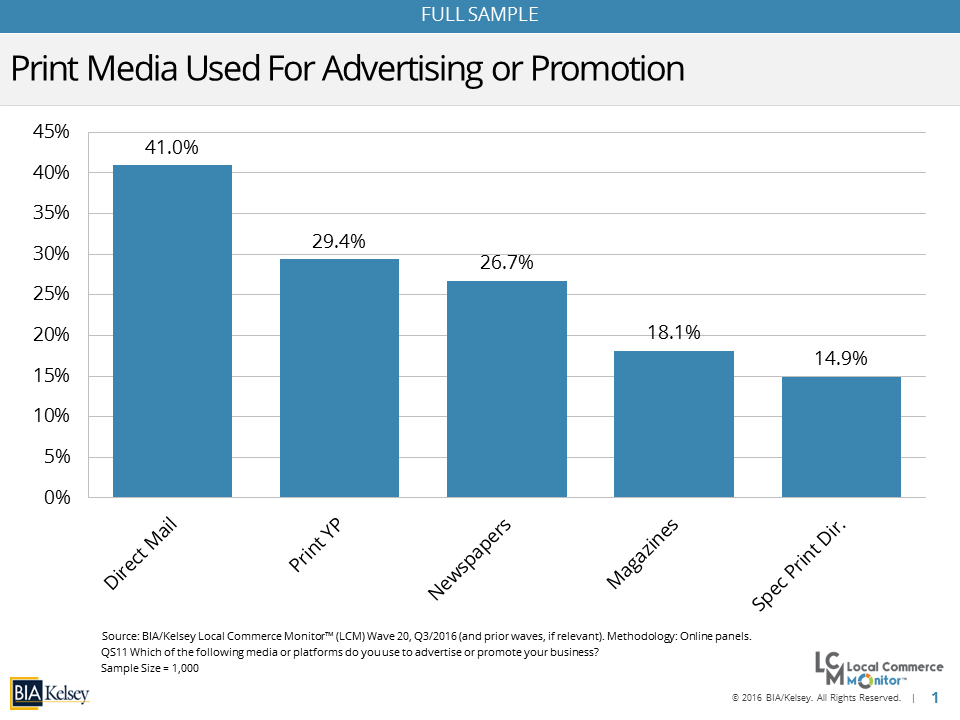

Year over year in BIA/Kelsey’s Local Commerce Monitor™ annual survey of small businesses traditional and some print channels continue to be an important part of a small businesses advertising strategies. SMBs reported usage of print media is shown in the table above. Among the full sample, direct mail leads the print media, with 41.0% of SMBs surveyed reporting they use direct mail for advertising and promotion (placing it in 2nd place in usage overall). 26.7% report using newspapers and 18.1% report using magazines.

Over half of the SMBs using magazines for advertising and promotion plan to maintain their current ad spend in the future, while 41.6% plan to increase spend. When it comes to return on investment (ROI), 27.5% of SMBs that use magazines reported excellent (10-19x spend) or extraordinary (over 20x spend) ROIs. Nearly the same number, 27.1%, reported good results (5-9x spend).

While 18.1% usage may seem low compared to direct mail’s 41.0%, the SMBs using magazines are seeing a return on their investment and say they plan to continue, or even increase, their spend on magazine advertising.

Online/Digital Local Ad Share Will Exceed Print Media by 2018

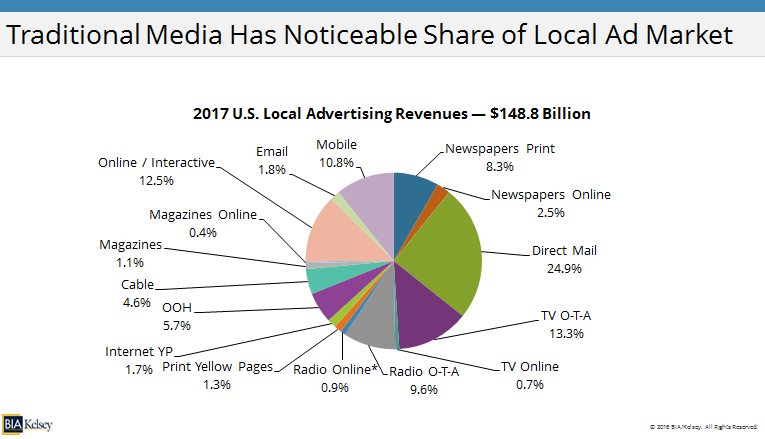

BIA/Kelsey released its latest U.S. local advertising forecast last week, estimating online/digital advertising will increase at 13.5 percent, from $44.2 billion in 2016 to $50.2 billion in 2017. That compares with a decrease of 2.4 percent next year for traditional — print and over-the-air — advertising revenues, which is predicted to go from $101.1 billion in 2016 to $98.6 billion in 2017. By 2018, BIA/Kelsey predicts, online/digital local ad share will exceed the share of print media.

In the press release Mark Fratrik, BIA/Kelsey’s SVP and Chief Economist, lists a range of factors that will drive local ad revenues higher in 2017 and through the end of the next year, including an improving U.S. economy, increased spending by national brands in local media channels, extraordinary growth in mobile and social advertising, and the continued expansion and selection of online/digital advertising platforms.

As shown in the chart below, many print channels are still strong with direct mail is projected to still be on top of the heap in 2017, garnering nearly a quarter of U.S. local advertising revenue. Although print advertising revenue is expected to continue declining, there is opportunity for revenue in print complemented with online. In fact the forecast shows the the growth in online (which includes magazines, newspapers and YP), is expected to help offset the losses. Print advertising, though losing share, is expected to continue to be a big part of ad dollars.

This Post Has 0 Comments