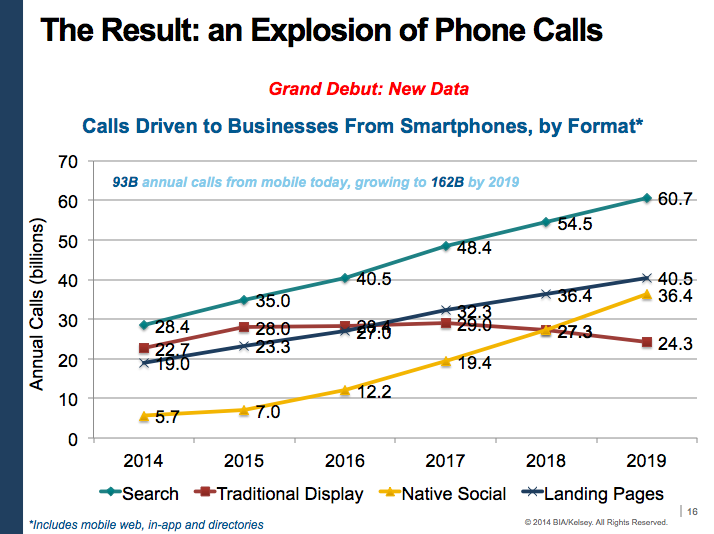

According to BIA/Kelsey’s latest research in call monetization, annual calls to businesses from smartphones will reach 162 billion by 2019. This is more than double the roughly 77 billion calls generated last year from mobile devices.

This is made up of search (paid and organic), traditional display ads, native social (in-feed) ads, and mobile landing pages. Our measurements include the iterations of these formats as they appear in both mobile web and in apps.

So what’s the biggest takeaway: When segmenting these sources of calls, the most interesting part was Native Social. Just like in our mobile ad forecast, this measures ads that merge with the scrolling feed-based interfaces of social apps like Facebook and Instagram.

Not only are these formats prevalent but they’re increasingly used as marketing vehicles. This can be seen in our mobile forecast and in guidance from companies like Facebook who’s in-feed ad units (news feed ads) now make up 73 percent of ad revenue.

But as it pertains to phone calls, these ad formats are likewise showing lots of promise to drive call volume. This can be seen most concretely in Facebook’s recently integrated call buttons within these native ad units, as part of its Local Awareness Ads.

We’re likewise seeing Twitter, Pinterest and Instagram integrate conversion-oriented buttons within native feed-based ad units. These are mostly “buy” buttons for m-commerce, but the next step will be “call” buttons for the much larger opportunity of offline commerce.

This rise of native social ads as a call driver clearly comes at the expense of traditional display, which shows flat growth. Meanwhile search leads all formats, due to its intent-driven use case that tends to boost calls (and clicks) to businesses from call extensions.

Landing pages also show healthy growth as a call source, partly driven by search. This is driven by the mobile web’s evolution, as Google compels the world to optimize mobile sites and landing pages. We also include directory apps like Yelp in this measurement.

But the main takeaway is that the mobile formats from which calls are driven are broadening. That impacts anyone driving and tracking high-intent phone leads to businesses, especially in high-value call-centric verticals like autos and financial services.

_________

This data set is the first step towards refreshing our call monetization white paper and overall coverage. We will be hosting a webinar later today, along with DialogTech, to discuss these findings and many other important factors, best practices and case studies in call analytics. You can register for free here.

This Post Has 3 Comments

Leave a Reply

You must be logged in to post a comment.

Inbound calls are on the rise as they create an instant connection between the prospect and a company. Now with so many communication options (email, Facebook, Twitter, online forms) customers want a direct and instantaneous connection with businesses. Instead of waiting for an email back, customers can speak directly with a representative from the company via a direct phone call.

Increase in phone calls also increased consumer expectations for immediate answers. Recent California Association of REALTORS data indicated that 49% of consumers expect an immediate response & 94% in less than 1 hour. Marchex recently indicated that 20% of calls are abandoned (delay in answering or going to VM). As Google releases Home Services Ad groups, it will be more important for local SMB businesses to have systems in place to handle the call volume and track all inbound call leads.

could you please indicate these phone calls are in US region or it is global wide? if it is global wide, what is the percentage of US region take?