When it comes to local commerce and loyalty programs, all roads lead to groceries. That?s the feeling of key companies in the space, including WalMart, Amazon, Google and eBay. Groupon this week announced Snap, a grocery coupon and loyalty program that gets it into groceries in a more meaningful way than prior efforts to go in via daily deals — where the discounts were not sustainable in an industry that is more dependent on “cents off” than “55 percent” off.

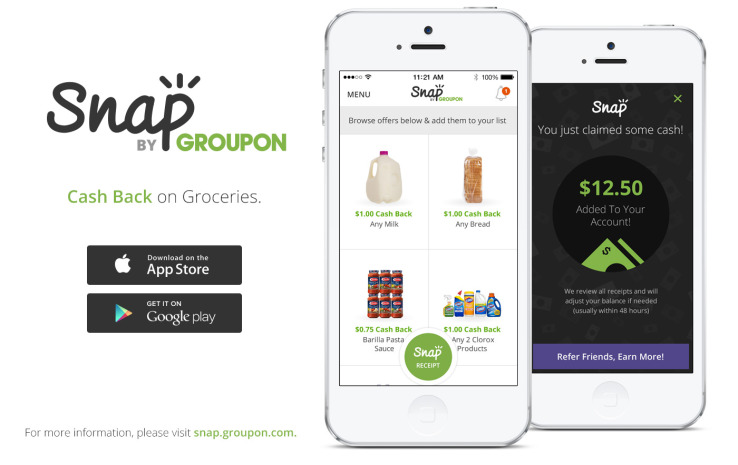

As reported in Chicago Business, Snap replaces Freebies, a coupon program launched in 2013 that has attracted 30,000 coupons from 7,000 retailers. Users of Snap receive offers and get money back after they aggregate $20 of discounts — if they upload photos of receipts showing the goods that were promoted. (This validation effort could prove a little klugey.)

While a robust grocery and delivery program has its own value, it may also lead to a key gateway into women shoppers; strong user behavior analytics; and peripheral deliveries or transactions with other goods such as electronics, etc. Groceries are also used more often than other key anchor promotion verticals, such as restaurants and services. Google similarly entered the grocery coupon business last year with the rollout of Zavers.

In Groupon’s case, the Snap program also supports its broader Marketplace effort, which allows advertisers to participate in many different channels (deals, coupons, ads). Seventy-five percent of Groupon business advertisers currently use Groupon for at least one feature in addition to the one-off deals. One of the key issues with Marketplace has been to provide a volume of listings so that searchers will always find things when they search for them. Currently, 9 percent of Groupon’s transactions emanate from Marketplace.

The Snap program does not get Groupon into dedicated home delivery — yet — but it does build out the marketplace, and could serve as an effective building block.

This Post Has One Comment

Leave a Reply

You must be logged in to post a comment.

Great post! We will be linking to this great content

on our site. Keep up the good writing.