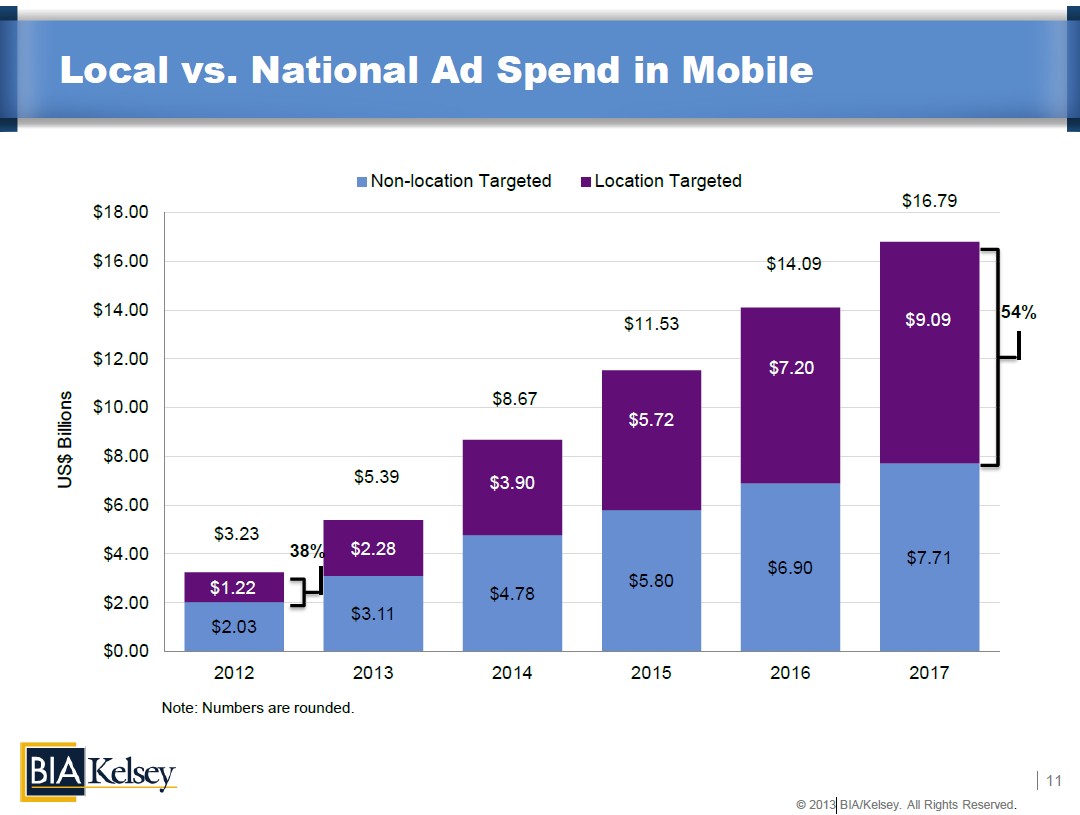

Last week we released our mobile local media forecast — one component of a forecast that spans all local ad media. The centerpiece of this mobile portion is the U.S. mobile local ad outlook, going from $1.2 billion last year to $9.1 billion in 2017.

This is a slice of the overall U.S. mobile ad market — an increasingly growing slice. But interestingly, though mobile local spending grew from our last forecast, it’s share of the overall market has gone down.

One reason is slower than expected adoption of localizaiton strategies by national advertisers. There’s also slower mobile adoption by SMBs. Thirdly, growth in the broader mobile ad market is being driven by ad formats that aren’t (yet) location based.

These include Facebook native social advertising (i.e. mobile news feed ads), which account for 23 percent of its ad revenue. Twitter is also seeing a growing share of mobile ad revenue. These are more contextual and reach-oriented than they are local (for now).

Here are a few other highlights from the report’s Executive Summary. If you’re interested in the full forecast or to discuss its findings, please go here, or reach out to me directly at (mbolandATbiakelsey.com)

— Compared to our previous forecast, mobile local advertising remained constant for 2012 but expanded in outer years. Growth will be driven by greater demand, ad performance and resulting ad rates (CPMs, CPCs).

— Google’s recently announced “Enhanced Campaigns” will compound these factors by forcing mobile ads on search advertisers (default campaign inclusion). This will accelerate a mobile advertising learning curve and adoption cycle for all search advertisers, including SMBs.

— Enhanced Campaigns will also notably close the current gap between mobile ad rates and desktop equivalents (rates are demand driven), as combined campaigns will defer to higher desktop pricing for simplicity.

— Mobile local figures are inclusive of total mobile advertising (see slide “Local vs. National Ad Spend in Mobile”). Like the mobile local figures above, overall mobile ad revenue grew from our previous forecast.

— This growth results from stronger guidance from mobile ad networks and ad share leaders such as Google ($8 billion global mobile run rate announced in October); and Facebook (23 percent of ad revenues attributed to mobile).

— The share attributed to localized mobile advertising (slide 11), however, declined as some of the driving forces for overall mobile advertising do not yet have local components (i.e. Facebook mobile ads).

— The localized share was also reduced due to slower than expected adoption of local strategies among national advertisers, who account for most U.S. mobile ad spending.

— SMB adoption — a slow but growing share of localized mobile advertising — is likewise challenged. This sector’s digital media adoption traditionally lags behind national advertisers due to lower levels of tech savvy, budget, time, and human resources.

— We expect many of the above factors to be allayed in the longer term, as the benefits of localized mobile advertising are realized and adopted by national and SMBs advertisers.

— Factors contributing to this shift will include innovation among ad networks and ad tech providers (i.e., Enhanced Campaigns), and local media resellers adoption of mobile bundles.

— On the national level, the shift will be driven by natural evolution of large brand advertisers to adopt effective, abundant, and currently undervalued mobile local ad inventory.

This Post Has 2 Comments

Leave a Reply

You must be logged in to post a comment.

La lecture du message de propriétaire, mon cœur était en réalité une longue période ne peut pas se calmer Air jordan

They didn’t Think I really could Develop Into Any we appreciate you this particular publish Expert Today I Am!Red Bottoms Outlet