You’ve probably heard by now that Microsoft has acquired Skype in an all cash deal for a whopping $8.5 billion. It’s Microsoft’s largest acquisition to date, and a killer exit for Andreessen Horowitz and others who made a then-controversial late stage investment in Skype in 2009.

There are good implications for this deal, which I’ll get into in a minute. There’s also a fair share of skepticism over the reasoning and purchase price. Rumors have been swirling about other suitors like Google and Facebook, but the price tag mostly competes with a rumored Skype IPO.

But is the price crazy, and is the reasoning sound? Consider the EBITDA multiple (32x), not to mention Skype’s $686 million in debt. Last year it lost $7 million on revenues of $860 million and operating income of $264 million (joining Microsoft’s own struggling online services division).

But what are the positives? I look to video calling integrations with Microsoft’s growing mobile and gaming assets. Picture it plugging into Xbox or IPTV hardware that Microsoft provides to U-verse and others, or with Kinect’s biometric interface and social/communications elements.

Regarding mobile this could be another differentiator for Windows Phone 7, scaling on the back of Nokia’s integration — particularly internationally where Skype shines. This also positions it as a competitor for Apple’s Face Time, which has been more of a novelty than a utility for many.

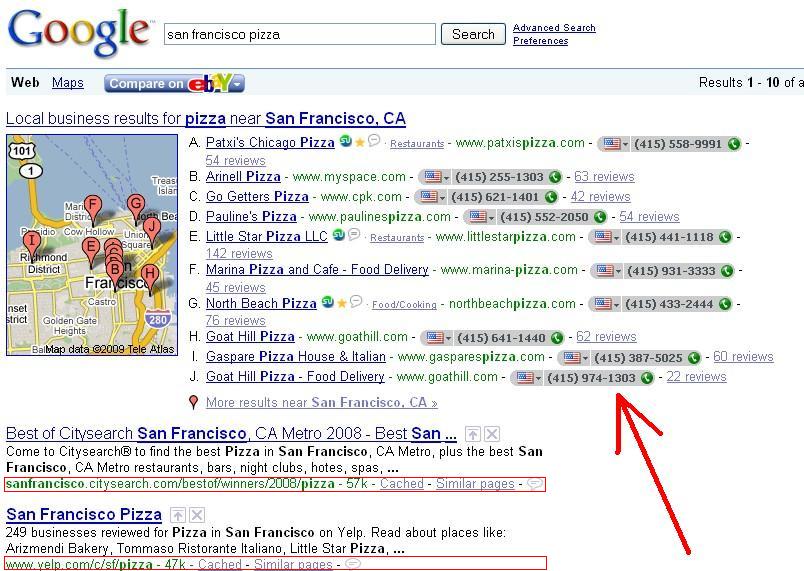

As for the local angle, there’s lots to discuss there — mostly playing off Skype’s efforts to facilitate and monetize calls to local businesses through search. That’s a story we broke a few years ago, and has steadily grown with partnerships with directory publishers and companies like Marchex.

This could bolster Microsoft’s own local search efforts through Bing. The name of the game for Bing (like Phone 7) has been differentiation to gain ground on Google, and Skype could play well into that strategy. It could also extend to the search volume gained from the Yahoo partnership.

So there’s clearly lots going on here (we haven’t even gotten into enterprise applications like Outlook). The question is whether Microsoft can integrate Skype without the red tape that will suffocate it. Or if it will prove unable to utilize its assets as intended — almost like eBay.

Back to the price tag, the consensus seems to be that Microsoft overpaid. But price won’t be an object if it can better monetize Skype’s global 663 million strong user base (equivalent to Facebook). That’s an area where eBay and even Skype itself failed. But the opportunity is huge.

Microsoft stock is down 1 percent so far today.

_________

Logo Image Credit: Dirk Houbrechts

This Post Has 0 Comments